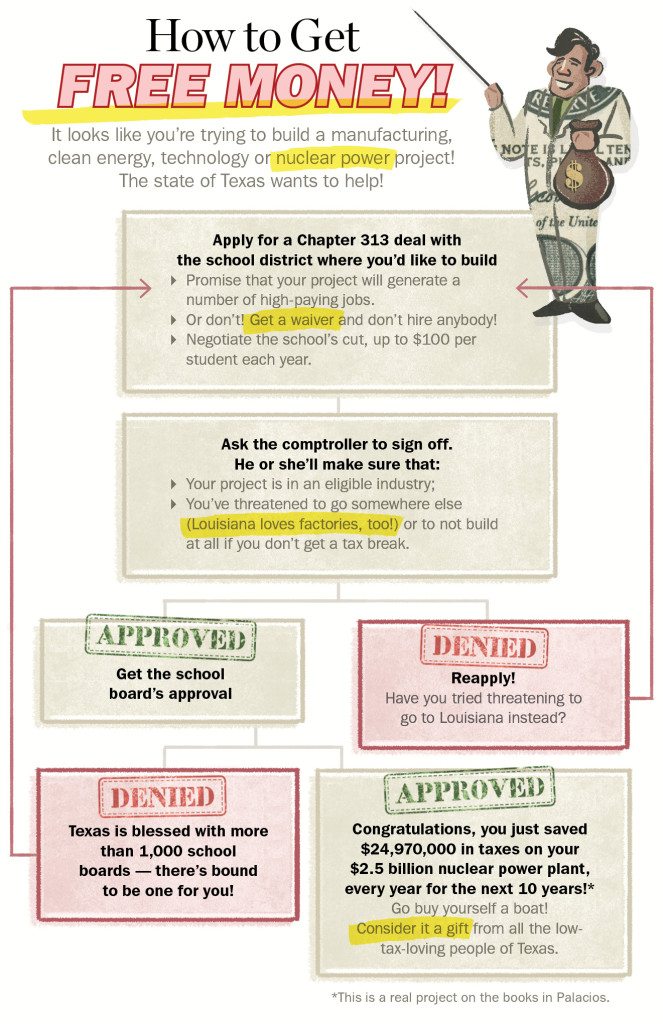

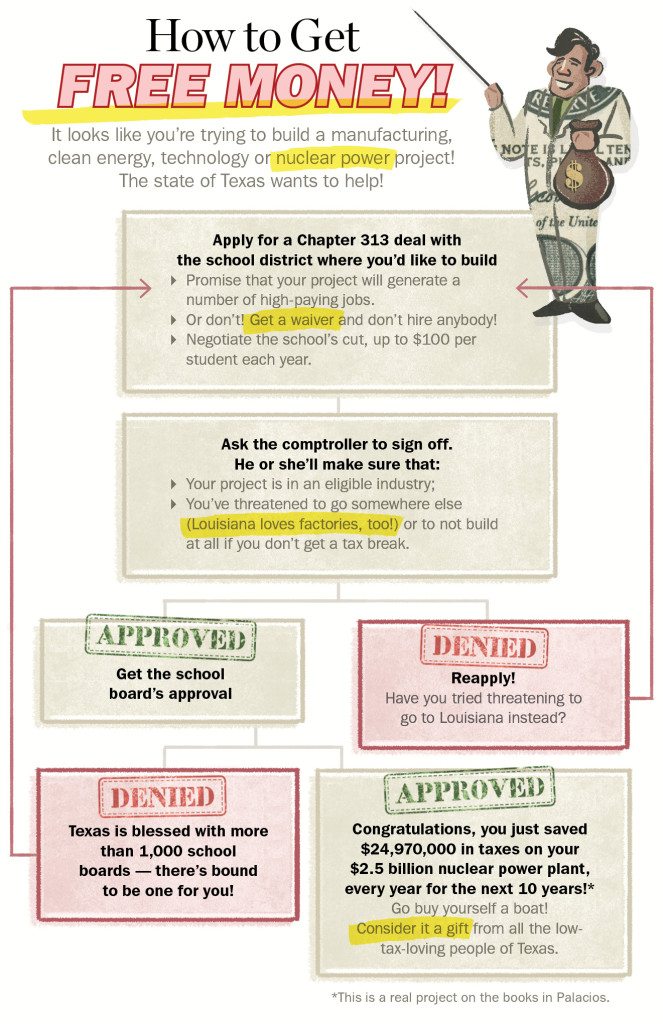

19+ Chapter 313 Texas

Web 2 days agoTexas can deny businesses seeking last-minute tax breaks under Chapter 313 court rules The Legislature voted to let the incentive program die at the end of 2022. Web Texas Chapter 313 Tax Abatement Program Renewable Energy Projects Renewable energy projects are returning 182 percent of their tax benefits back to the school districts.

Texas Speaker Says Legislature Will Revive Chapter 313 Tax Break Program The Texas Tribune

Web The Texas comptrollers office has until Dec.

. Web But even if Chapter 313 goes away Texas will feel the effects for years to come. A This subchapter and Subchapter C apply only to property owned by an entity subject to the tax imposed by Chapter 171. There are more than 500 active deals that the state is on the hook for and many.

Contact your Texas Representative and Senator. Web 2 days agoThe Texas comptrollers office has until Dec. Texas Chapter 313 which reduces school district property taxes for capital-intensive facilities to attract economic development to the state.

Web Texas Economic Development Act. A Texas school district has ratified a tax incentive agreement for a proposed crude refinery project on the Gulf Coast. Web Chapter 313 is up from renewal in 2021 in this 87th Legislative Session.

Web Texas Tax Code Chapter 313 aka the Texas Economic Development Act creates a state tax incentive program for certain large businesses to limit the appraised value on their. 31 to get companies into the program known as Chapter 313 and give them a 10-year discount on their property taxes. Web March 7 2022 145 AM.

31 to get companies into the program known as Chapter 313 and give them a 10-year discount on their property taxes. If no action is taken it will simply expire. Web Web Dec 19 2022.

An appraised value limitation is an agreement in which a taxpayer agrees to build or install property and create jobs in exchange for. Opponents have argued that. Web Dec 19 2022.

Web 2 days agoThe Texas comptrollers office has until Dec. 31 to get companies into the program known as Chapter 313 and give them a 10-year discount on their property taxes. 31 to get companies into the program known as Chapter 313 and give them a 10-year discount on their property taxes.

B To be eligible.

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/TURXJBZ2D7NLEUSPOVVPB7P4VU.jpg)

Texas Lawmakers Need To Rethink The Program That Gives Property Tax Breaks To Corporations

Autologous Bone Marrow Transplantation Blog Science Connections

:watermark(cdn.texastribune.org/media/watermarks/2021.png,-0,30,0)/static.texastribune.org/media/files/899c10fd052f29c167bc07f438154c92/Ott%20Elementary%20COVID%20AG%20TT%2024.jpg)

A Texas Law Offers Tax Breaks To Companies But Its Renewal Isn T A Done Deal The Texas Tribune

2016 Imaginenative Catalogue By Imaginenative Issuu

Meet Chapter 313 Texas Largest Corporate Welfare Program

What Will The End Of Chapter 313 Tax Abatements Mean For Austin Austin Business Journal

Chapter 313 Agreements Texas Schools For Economic Development

Use Ctrl With Home To Return To The Title Page The Gospel Origins

Texas Chapter 313 Corporate Welfare Program Comes To An End

Us10189894b2 Rationally Designed Synthetic Antibody Libraries And Uses Therefor Google Patents

Texas Business Groups Push Legislature For New Corporate Tax Break Program

To Be Or Not To Be Texas Chapter 313 Lexology

Calameo File Under Jurassic Rock D Temporary 2011

Pdf The Leader In Me An Analysis Of The Impact Of Student Leadership On Science Performance Matthew Ohlson Ph D Academia Edu

Testimony House Committee On International Relations Economic Development April 20 2022

Texas Chapter 313 Incentives To Soon End What Companies Are Still Waiting On Requests Austin Business Journal

Texas Business Groups Push Legislature For New Corporate Tax Break Program